- #Tax tags and title calculator pa registration#

- #Tax tags and title calculator pa license#

- #Tax tags and title calculator pa zip#

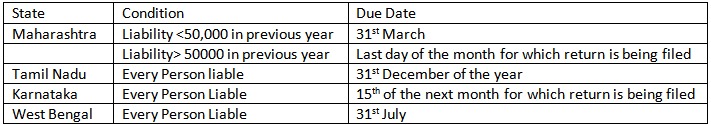

ITEMS SUBJECT TO THE PERSONAL PROPERTY TAX Revenue collected from the personal property tax is used to fund services like police and fire protection and other services such as parks, libraries, and education. states do not as a result, some County residents may not be aware that a tax on personal property exists.

#Tax tags and title calculator pa registration#

Personal property tax applies to any vehicle normally garaged or parked in Prince William County - even if the vehicle is registered in another state or county.A higher-valued property pays more tax than a lower-valued property. It is an ad valorem tax, meaning the tax amount is set according to the value of the property. Personal Property Tax (also known as a car tax) is a tax on tangible property - i.e., property that can be touched and moved, such as a car or piece of equipment. DMV Police Reports Pennsylvania taxes vehicle purchases after rebates or incentives are applied to the price, which means that the buyer in this scenario will only pay taxes on the vehicle as if it cost $9,000.WHAT IS PERSONAL PROPERTY TAX? New Resident Vehicle Guide Title and escrow orders, property information, and more. If you already have a Pennsylvania registration plate, a Department of Transportation agent can transfer it for you. This fee is meant to cover the cost of the dealership preparing the sales contract and legal paperwork. Both registration periods and the required fees are provided on the registration renewal form or Calculating Tax Payments and Total Amount Due. Dealerships apply extra fees, sometimes referred to as "doc fees," with the sale of the car.

#Tax tags and title calculator pa zip#

Inspections Smog & Emissions You can use our Pennsylvania Sales Tax Calculator to look up sales tax rates in Pennsylvania by address / zip code. Insurance Center Tax information and rates are subject to change, please be sure to verify with your local DMV. In a few years, the price to transfer a title in Pennsylvania might be up to $60.

#Tax tags and title calculator pa license#

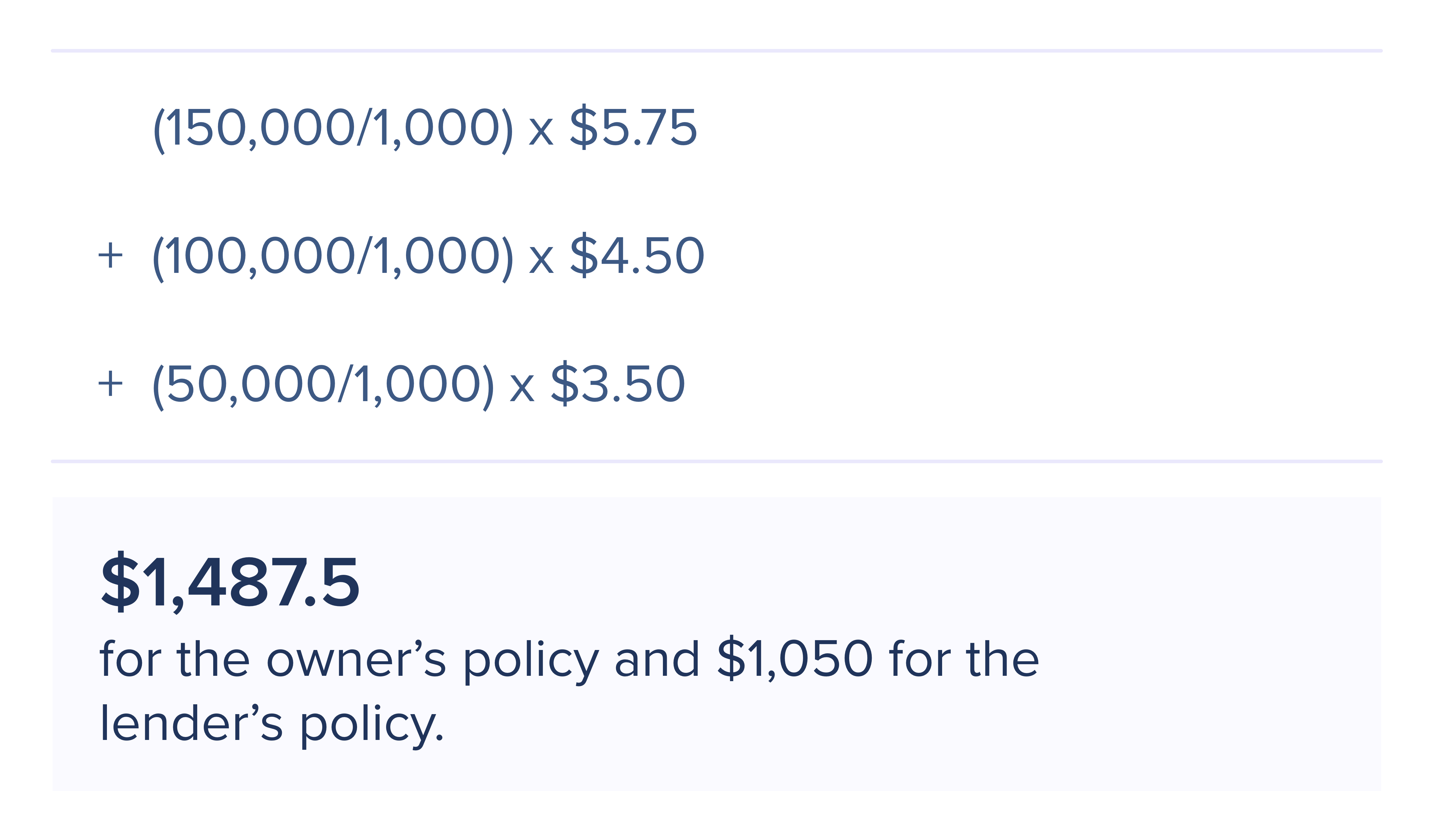

id="calconic_", b="" A car payment with PA tax, title, and license included is $ 700.90 at 4.99 % APR for 72 months on a loan amount of $ 43444. Dmv Office and Services (function() Info, Order Or even that used Hyundai? Insurance Discounts 6% titling sales tax on vehicles over $500, $200 annual EV fee, $100 plug-in hybrid fee $10 lien fee, $10-$30 wheel tax (varies by county) $100 annual EV fee, $75 hybrid fee. Only these four documents count as proof of insurance: Be sure you know the laws and fees that come with buying a car from a dealership or a private seller before you hand over your money. Find the best insurance for your budget in just a few minutes! Model Year: 2021. It's up to the parties taking part in the sale to prove to a notary that the vehicle's fair market value is lower than the Department of Revenue's estimate. State Regulations The basic DMV fees, like the title, license plate, and registration fees, are no biggie.

0 kommentar(er)

0 kommentar(er)